A Fintech Journey through Google’s Design Sprint Credit Score Validation

Unlocking Financial Potential with User-Centered Design

What is DigiPay?

Noavaran Pardakht Majazi Iranian Co. under the brand name of Digipay, part of Digikala Group, working in payment ecosystem with the vision to enhance the quality of customers experience in online payment. Digipay is working toward building payment products that offer easiest and secure by practice e-payment experience for individuals and businesses...

Introduction

In this case study, we explore how the design sprint methodology, inspired by Google's approach, revolutionized credit score validation for Digipay, a key player within the Digikala Group's payment ecosystem. This initiative was driven by the need to enhance customer experiences in online payments, particularly in addressing the challenge posed by credit score limitations. By leveraging the design sprint process, we aimed to develop a solution that not only addressed the existing gaps but also set new standards for inclusivity in the financial services sector.

Problem Statement

Digipay faced a significant challenge within the Iranian market—a considerable segment of users was unable to access credit and Buy Now, Pay Later (BNPL) features due to credit scoring discrepancies. Traditional credit scoring systems excluded users without a banking credit score, even those with responsible financial behavior. This exclusion not only limited users’ access to essential financial services but also constrained Digipay’s business potential in an emerging market where financial inclusion is paramount.

The Visionary Solution

To address this challenge, we developed a groundbreaking solution that leveraged Digikala and Digipay’s extensive user base of over 4 million individuals. We implemented a sophisticated algorithm designed to analyze user financial behavior beyond traditional banking metrics. This algorithm considered alternative data points, such as purchasing patterns and payment history, to assess and gradually shape users’ creditworthiness. By doing so, we aimed to empower users who were previously sidelined by conventional credit scoring systems, unlocking new financial opportunities within the Digipay ecosystem.

The Design Sprint Process

Benchmarking

Before initiating the design sprint, we conducted a comprehensive benchmarking exercise to study global credit scoring systems. We analyzed models from diverse markets, including the FICO score in the United States, the Schufa system in Germany, and alternative credit scoring methods in emerging markets. This analysis provided us with critical insights into various approaches to credit assessment and informed the development of a customized solution tailored to the unique needs of the Iranian market.

Stakeholder Interview

Stakeholder interviews were instrumental in shaping our understanding of organizational priorities and user expectations. Through these discussions, we identified the importance of building trust with users as a key driver for the credit score feature. Stakeholders emphasized that the solution needed to be transparent and user-centric, ensuring that users understood how their financial behavior influenced their creditworthiness and what steps they could take to improve it.

“How Might We...?” Statements

Drawing from the insights gathered, we crafted open-ended 'How Might We' (HMW) statements to guide our creative process. For example, 'How might we enable users to build creditworthiness through everyday financial interactions?' These HMW statements served as a compass throughout the sprint, ensuring that our solutions remained aligned with user needs and business objectives.

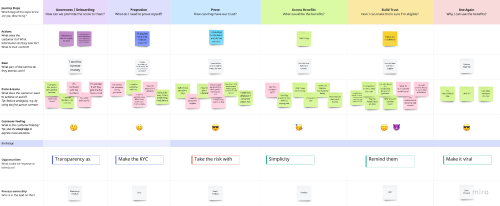

Note-N-Map and Customer Journey Map

In a collaborative Note-N-Map session involving eight users, we mapped out the entire customer journey to identify pain points and opportunities for trust-building. This exercise revealed critical moments where users felt uncertain or excluded from financial services, providing us with a clear roadmap for enhancing their experience. By visualizing these interactions, we were able to pinpoint where and how our solution could make the most impact.

Crazy 8s

During the Crazy 8s ideation session, our team embraced creative freedom to generate a wide range of solutions for the identified challenges. Within just eight minutes, we each sketched eight distinct ideas, resulting in a diverse pool of concepts. This rapid ideation process helped us push beyond conventional thinking and laid the foundation for innovative solutions that were further refined in subsequent stages.

Iteration and Testing

User Testing and Prototyping

Prototyping and user testing were pivotal in refining our solution. Throughout multiple iterations, we tested different prototypes with users, gathering feedback and making necessary adjustments. Initially, users found certain aspects of the interface confusing or unintuitive, leading us to redesign key features. By the fourth iteration, we had addressed these concerns, and our final prototype reflected significant improvements in usability and user satisfaction. Each iteration brought us closer to a solution that was both effective and user-friendly.

SUPR-Q User Testing

To validate our final design, we conducted a user testing study using the SUPR-Q (Standardized User Experience Percentile Rank Questionnaire) measure. This tool assessed satisfaction across several dimensions, including usability, credibility, design, and overall satisfaction. Our solution achieved a SUPR-Q score of 9.4 out of 10, indicating a high level of user satisfaction and confirming that our design met the needs of our target audience.

The Impactful Result

The culmination of this design sprint was a user-friendly interface that presented credit scores in a clear, accessible format. The solution not only met the expectations of our stakeholders but also resonated deeply with our target users. In a follow-up survey involving 50 participants, we observed a statistically significant increase in user engagement and satisfaction. Digipay successfully broke down the barriers imposed by traditional credit scoring, offering a more inclusive and empowering financial experience to its users. This initiative has set a new benchmark for financial inclusivity in the region, expanding access to credit for previously underserved segments of the population.

This case study demonstrates the transformative power of user-centered design and the effectiveness of the design sprint methodology in addressing complex challenges in the fintech industry. By reimagining credit score validation, Digipay has paved the way for a more inclusive financial ecosystem, where users are not solely defined by traditional credit metrics. The success of this project highlights the potential for design sprints to drive innovation and deliver impactful solutions, setting a precedent for future initiatives within the fintech space and beyond.